In a globalized trade environment, it is crucial for companies to understand the tariff policies of various countries. Especially for consumer goods such as umbrellas, when exported to the United States, the impact of tariffs may be directly related to the market competitiveness of the product. This article will explore the US tariff policy on customized umbrellas and its potential impact, providing a reference for foreign trade companies.

US Tariff Policy on Umbrellas

According to statistics from the United States International Trade Commission (USITC), the tariff policy of umbrellas is mainly classified based on the material, purpose and design of the product. Umbrella wholesalers are usually classified under HTS (Customs Commodity Scheme) code 6601, and the specific tax rate may vary depending on factors such as material and structure. Here are some key points:

Standard tariff rate: Generally speaking, the tariff rate for ordinary umbrellas is between 8%-9%. However, folding umbrellas, transparent umbrellas or umbrellas with special functions may have different tax rates.

Anti-dumping and countervailing duties: For umbrellas from certain countries (such as China), there may also be anti-dumping and countervailing duties. These rates are usually specific to a specific producer or exporter, and the usual additional rates range from 10% to 25%.

Tariff Exemptions and Preferences: In some cases, companies can apply for tariff exemptions, especially in the new product development or market development stage. Taking advantage of this policy can reduce the tax burden to a certain extent.

Tariff Considerations for umbrellas in bulk

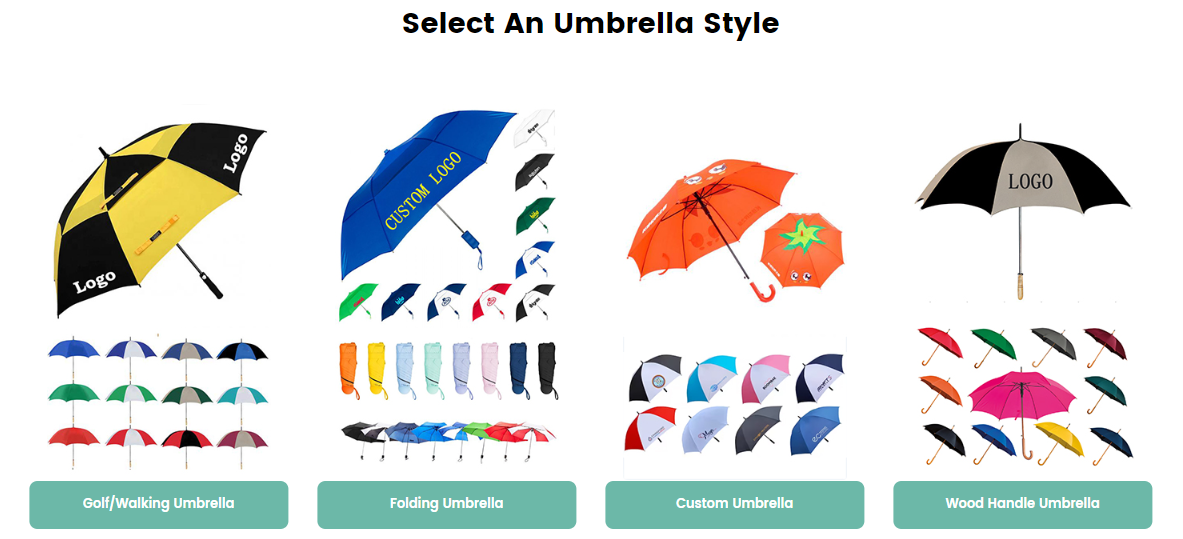

For custom umbrellas, especially those with special designs or brand logos, tariff policy considerations are more complicated. Here are a few factors that affect tariffs on custom umbrellas:

Rules of Origin: The United States has strict requirements on the origin of products. If the main materials or assembly of umbrellas are all in China, they may face higher tariffs. Therefore, moving production lines or part of production to countries with tariff preferences (such as Vietnam or other Southeast Asian countries) may be an effective strategy to reduce tariffs.

Material Composition: The types of materials used in Automatic folding umbrella will affect the way tariff classification is applied. If more domestic materials are used, it may help reduce tariffs. For example, using plastics or steel made in the United States can reduce tariffs by taking advantage of the United States' free trade agreements.

Documentation and Compliance: Make sure all documentation and compliance requirements, such as certificates of origin and trade agreements, are valid. This can reduce unnecessary troubles at customs declaration while avoiding potential penalties for misclassification.

How to reduce tariff costs through customization strategies

Choosing suitable materials: Choosing materials that can reduce tariffs, such as local materials in the United States, or optimizing material combinations based on free trade agreements can effectively reduce tariffs.

Reasonable design: When designing umbrellas, consider their functions and structures to facilitate the use of different tax rates. Certain design forms may be subject to lower tariffs.

Diversified production: Consider using a multi-country production strategy to effectively disperse risks and tariff burdens and increase market adaptability.

As the global economy continues to change, the US tariff policy is also constantly adjusting. Understanding the relevant US tariff regulations on customized umbrellas will help foreign trade companies develop more flexible market strategies. Whether through material optimization, production site transfer, or design innovation, companies can reduce tariff burdens and improve market competitiveness to a certain extent.

Address : Huli High-tech Park, Huli District, Xiamen, Fujian, China

Please read on, stay posted, subscribe, and we welcome you to tell us what you think.

Copyright © Susinoumbrella.com - DYY LIMITED All Rights Reserved.

Sitemap

| Blog

| Xml

| Privacy Policy

Network Supported

Network Supported